1) Prices are Trending Up

If you have been on the sideline and trying to decide whether to buy or rent your indecision has cost you a great deal. Now many of the people that have “waited” have waited too long. Prices are up and affordability, meaning how much home you can afford based upon your current income and debts, has fallen significantly the last eighteen months. While prices seem high in relationship to recent prices they are slightly below the general trend line in most metropolitan areas, with the primary exceptions being New York and certain parts of California.

You can always wait and see or you can jump in now. Prices flattened out in April 2014 and many analysts are seeing this as a downturn. I personally believe that it is a slowdown and prices could drop slightly but long term they will continue to rise at a rate of about 3%. Since real estate is location specific your home town may be different. It you are in an area with declining prices proceed with caution and read my post “Four Reasons Not To Buy a Home”

2) Rates Will Never Be Lower (and most certainly will go higher)

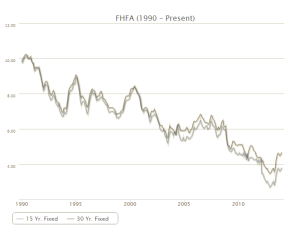

The vast majority of owner occupied homes are purchased with financing. Financing is a major component in determining your house payment. As I write this article prevailing lending rates have stabilized at around 4% and that is a great rate. If you look back a year and see rates around 3% and want to wait for them to fall before you buy, good Historically rates will fluctuate as you can see the chart to the left.:interest_rate_chart

This chart began in 1990 and rates were above 10% and after the great recession they dropped to around 3%. I can remember in the 1980’s that you had to pay over 18% for a 30 year fixed rate. Believe me rates are historically low and will no doubt will go higher.

How much can this effect your payment? by way of example if you financed a $220,000 home and put $20,000 (10%) down your payment for Principal and Interest on a 30 year loan would be $955. Should you wait a year or two and rates go up to the recent historic average of 8% your new P and I payment would be $1,468. That payment could be out of your reach based upon you income and debt load. The result is you would need to keep waiting or buy a less expensive home.

3) Availability of Money May Get Worse

There is currently a large ground swell of support to get the government out of the mortgage business and to do away with and FANNIE MAY and FREDDIE MAC. These are the two private companies that the federal government guarantees loans for. The effect of eliminating these two agencies could no doubt drive rates higher and may it more difficult to qualify for loans.

4) Wealth-Home Owners are 17 Times More Wealthy Than Non-Homeowners

The main monetary reason to purchase a home is wealth. It is simple math if you own a home and pay it off you will not have house payments any longer. In the meantime you accumulate equity and lock in a payment that will stay the same for the life of the loan. The landlord is not there to raise your rent. You basically have an insurance policy that housing costs cannot go up.

Statistically homeowners have 17 times more wealth than no-homeowners.

This huge advantage can only be yours if you own a home.

5) It Is Yours

Maybe the single biggest reason for you to buy a home has nothing to do with money. If you are one of those people that put down roots and love to add unique touches to your home the big reason to buy a home is that it is yours. You can do what you want to do. No landlord telling you can’t paint your daughters room pink or that you dog is over 60 pounds so you have to move. Freedom and a sense of belonging are two emotions that cannot be overlooked and there is no monetary price you can put upon them.

If you think I am trying to sell you on home ownership I'm guilty as charged It is one of the best ways to insure your emotional well being and financial future. I offer another post on this site that is an objective list of Four Reasons Not To Buy a Home. Please check it out if I haven’t talked you into home ownership.